.png)

Wohoo!

You are subscribed to our blog newsletter

Awesome!Personal loans: Everything you need to know

A personal loan offers a lump sum that can be used to combine and consolidate credit card debt.

A personal loan is a form of credit that typically offers a lump sum up front and is paid back with predictable monthly amounts over a specific period of time.

Personal loans can help you make a big purchase or consolidate high-interest debts, like credit cards.

They can also vary widely. Personal loans can be provided for different amounts, large or small, and with differing interest rates, fees and repayment terms.

Most personal loans are a secured type of loan, which require an application process reviewed by a lender. Secured loans also typically require collateral.

Let’s look at how they work and when they make good sense.

Use personal loans for credit card consolidation

Personal loans often carry an interest rate lower than many credit cards, so they can be used to combine card debts into a single, lower-cost monthly payment.

If you use a personal loan to pay off credit cards, you’ll secure the loan and use the lump sum to pay off credit cards with higher interest rates. Going forward, you’ll make one monthly loan payment, instead of payments to multiple cards, juggling due dates and balances. Your loan payment is predictable month after month, and you’ll pay less in interest charges over the life of the loan.

When you use a personal loan as a debt consolidation loan, you can clear your credit cards fast and boost your credit score.

But your behavior with the loan is also part of your credit history.

Use personal loans for big purchases

Another way to use a personal loan is for personal expenses, like home improvements, major medical bills, wedding or funeral costs, or unexpected expenses.

Some lenders restrict how you can use a personal loan. For example, if you’re planning to use a personal loan to pay for college tuition or fees, you may not qualify with some financial institutions. In this example, talk to your lender about available student loans.

Some personal loans are labelled and marketed by their intended use. So a "personal loan" may sometimes be called a "home improvement loan".

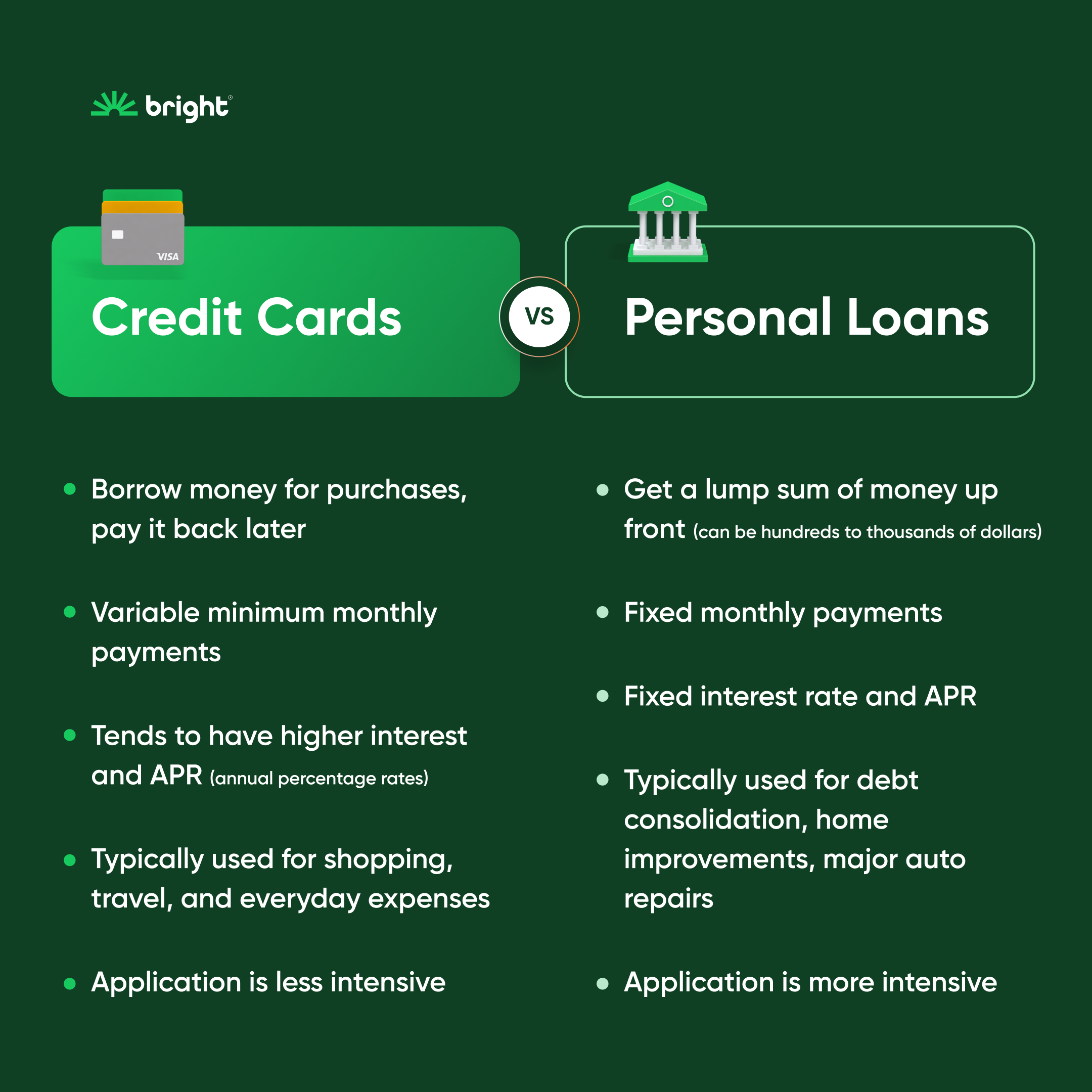

Credit cards vs personal loans.

How to get a personal loan

Most personal loans are secured with collateral - which is property or an item of value the lender can claim if you don't repay the loan. The most common forms of collateral include your home, your car or a luxury item.

Start with your bank or credit union. See what types of personal loans they offer and compare with the loan terms offered by other lenders .

In addition to lower interest rates, the best personal loans offer low origination fees and low or no prepayment penalties. These terms are another way to compare different loan offers.

The loan application requires reviewing your creditworthiness, with your credit card debt, credit score and debt-to-income ratio reviewed and used to determine the loan amount, the interest rate and other terms.

Personal loans work like most other forms of credit: your behavior with the loan is reported to credit bureaus, like Experian, TransUnion and Equifax. Late payments or partial payments can show up on your credit report.

Unsecured personal loans are also available, but they often require excellent credit and an exceptional credit history in lieu of collateral.

Personal loans fall under the category of "instalment loans," which means they're loans for a fixed sum with predictable monthly payments.

Consider alternative types of credit

Common alternatives include a home equity loan or line of credit and a personal line of credit. The first two use the equity in and value of your home as a collateral and to determine the amount and terms to offer you.

With a line of credit, instead of a loan's lump sum, you'll have access to cash and credit up to a set limit. You can access a lump sum, if that makes sense, or use it like a credit card.

Use Bright Balance Transfer for debt consolidation

Bright does not offer personal loans. But we can help pay off your card debts faster.

Bright Balance Transfer offers a low-interest line of credit designed to pay off card debt fast while saving you from high interest charges. It works a little like a personal debt consolidation loan. Once approved, Bright uses the funds from your Bright Balance Transfer to pay off your high-interest cards, moving those debts to our balance transfer program with its lower APR. Over the months ahead, Bright automates your new repayments, too, so you pay less in interest and it’s hassle-free. Bright Balance Transfers offers credit lines of up to $10,000 at APRs starting from 9.95%, depending on your eligibility.

Bright Credit Builder is an easy way to boost your credit score. With a healthy credit score, you can qualify for more credit and loans, often with lower interest rates. Once you’re signed up, we’ll set up an interest-free, secured line of credit and use it to make automatic payments on your cards, building a positive payment history and lowering your credit utilization. Bright Credit Builder focuses on utilization and payment history because as they improve, your credit score goes up!

Bright can also help get you debt-free by managing your card payments for you. With a personal Bright Plan, we’ll use our patented MoneyScience™ to study your finances, learn about your debt and make smart payments, always on time and optimized to save you money and get you debt-free fast.

If you don’t have it yet, download the Bright app from the App Store or GooglePlay. Connect your checking account and your cards, set a few goals and let Bright do the rest. With a personal Bright Plan, you can apply for Bright Credit Builder or Bright Balance Transfer or use MoneyScience™ to pay off your cards fast.

Recommended Readings:

With a postgraduate degree in commerce from The University of Sydney, Pranay has his finger on the pulse of the finance industry. Breaking down complex financial concepts is his forte.