.png)

Wohoo!

You are subscribed to our blog newsletter

Awesome!Personal loans vs. Credit cards: What's better?

Credit cards offer a convenient way to make purchases online and in person.

Finding the right credit solution can bring new flexibility, with access to funds that keep you moving forward. Let’s look at how personal loans and credit cards work and find the right one for you.

Credit cards enable convenient, secure shopping and transactions

Credit cards provide a convenient and secure way to pay for purchases and make other transactions, both in person and online. They're a common feature of modern life, accepted broadly and used with confidence.

Credit cards are easy to apply for, usually requiring your affirmation of your annual income, with a fast review process. If approved, you'll be assigned an account and a card with unique identifying numbers. Your card will also be assigned a credit limit, which limits the amount of money your card issuer will lend you.

How to use a credit card

With a credit card, you present your card when you make a purchase - with the agreement you'll pay for it later. At the end of each month, you receive a statement that details the purchases made with your card during the month and how much you owe.

The statement also presents your payment options, and your options will vary month to month, depending on how much you owe and any fees or charges.

Typically, you're offered three payment options: the full balance, a partial amount or the minimum payment due. (The minimum due usually covers just the interest you'll be charged if you choose to carry the full balance until the next month.)

Most experts recommend paying the full balance each month. If you pay less than the full balance, you’ll pay interest on the balance you’re carrying forward. The more balance you carry, the higher your interest charges will be.

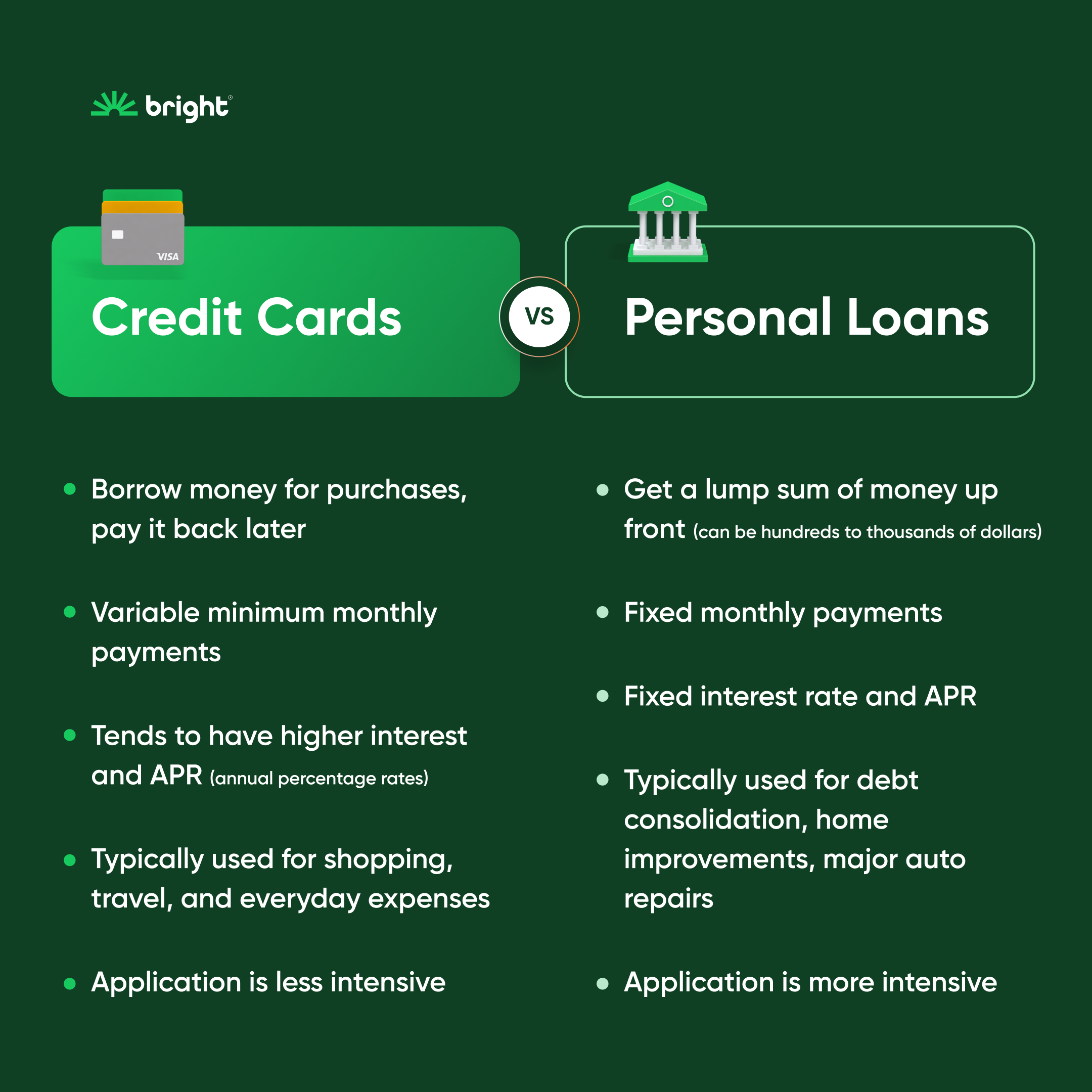

Credit cards vs personal loans.

How to find the right credit card

Look for cards with a low APR ("annual percentage rate"), no annual fee, low late fees, a comfortable credit limit, and rewards that make sense for you, like cash back or travel perks.

The better your credit history, the better terms lenders will offer you on your credit cards. With excellent credit, you'll be offered a higher credit limit and lower interest rates. With a poor credit report, you might face higher interest rates.

Most credit card issuers offer cash advances, but they typically charge higher interest rates for the service.

Some cards are designed as "balance transfer credit cards." They usually offer a low or 0% intro interest rate for the first several months, to encourage you to move funds from cards with higher interest rates. The intent is to allow you to pay off those debts over the months the low or zero interest rate applies. But be aware that some issuers charge one-time balance transfer fees.

Knowing how credit cards work can make all the difference. With responsible use and repayments, your credit score improves, your creditworthiness gets a boost, and you'll have access to the best credit cards with more competitive rates and perks.

Technically, credit cards are "unsecured loans," which means issuers don't require collateral or an intense review process.

A personal loan can finance large purchases and debt consolidation

A personal loan is a secured loan, requiring collateral and approval by a lender. The application process can take some time, often longer than applying for a credit card.

When you apply for a personal loan, you'll need a credit report to prove your creditworthiness and something of value - like your home, your car or luxury items - to serve as collateral, that your lender can claim if you don't pay the loan back.

How to use a personal loan

In contrast to credit cards, personal loans typically provide a lump sum of cash. Instead of borrowing for each purchase, like you do with a credit card, a personal loan provides a large amount up front, which you can apportion and spend as you like.

Your payments are the same every month, at a fixed rate. So you'll always know how much is due.

Borrowers who take out personal loans often use them for large purchases or to finance big projects, like home improvements or major auto repairs.

How to use a personal loan for debt consolidation

Personal loans are also used as debt consolidation loans, where the lump sum is used to pay off credit cards. Convenience and savings are the primary rationales: streamlining debt management to the loan's on monthly payment, and paying less in interest charges with the loan's lower interest rate.

Before taking on a personal loan, make sure the APR is lower than your cards' and the loan amount is enough for your planned use. Check the repayment terms too, to ensure they fit your budget, and ask about origination fees.

Like credit cards, always note payments' due date, and like with card issuers, good credit can translate to lower interest rates, and bad credit can result in a high interest loan.

Know how your credit options work

Keep in mind that personal loans aren't the same as instalment loans, which require repayment of your balance at the end of every month or billing cycle. Instalment loans are also increasingly rare, and they aren't usually recorded on your credit score, so they may not be a good option if you're trying to boost your creditworthiness.

The best personal loans work for you, your money and your bottom line - the demands of your own household's personal finance.

Before taking on more of any types of credit, make sure you're not overdoing it. Lenders and credit card companies often review your credit utilization - which reflects how much of your available credit you use at any given time. If a new credit card or personal loan invites more spending, make sure you're looking at overall credit use. Most experts recommend using no more than 30% of the credit available to you.

Use Bright to manage your card debt

Bright doesn’t offer debt consolidation loans. But we can help you get debt-free faster, save you money on interest charges and do it all automatically.

Bright Balance Transfer offers a low-interest line of credit designed to pay off card debt fast while saving you from high interest charges. Once approved, Bright uses the funds from your Bright Balance Transfer to pay off your high-interest cards, moving those debts to our balance transfer program with its lower APR. Over the months ahead, Bright automates your new repayments, too, so you pay less in interest and it’s hassle-free. Bright Balance Transfers offers credit lines of up to $10,000 at APRs starting from 9.95%, depending on your eligibility.

Bright Credit Builder is an easy way to boost your credit score. With a healthy credit score, you can qualify for lower interest rates on cards and loans. Once you’re signed up, we’ll set up an interest-free, secured line of credit and use it to make automatic payments on your cards, building a positive payment history and lowering your credit utilization. Bright Credit Builder focuses on utilization and payment history because as they improve, your credit score goes up!

Bright can pay off your card debt faster, too. With a personalized Bright Plan, we’ll use our patented MoneyScience™ to learn about your finances, follow your goals and make payments for you - automatically. You'll pay less in credit card interest, you'll see improvements in your credit score, and you’ll get debt-free faster.

If you don't have it yet, download the Bright app from the App Store or Google Play, connect your accounts, and get a faster, smarter way to pay off your debt.

Recommended Readings:

Aayush has worked 5 years in the digital advertising space with Bright Money, InMobi and YourStory.